– Turn tokenized real estate into a liquid asset

– Create transparency in global real estate trading

– Create liquidity for real estate with the BRICK token(AMM)

– Enhance Liquidity

– Facilitate Trading

– Accrue Staking Rewards

– Lending and borrowing

– Early access to real estate tokens

– Received two grants from Balancer so far

– 13,000+ subscribers on our social media channels

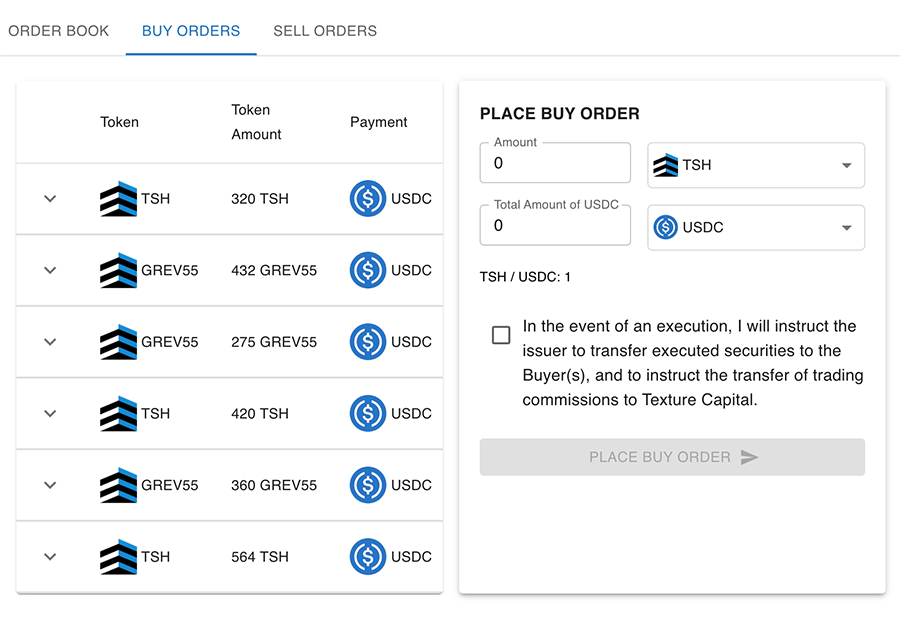

– Finished implementation of orderbook marketplace

– Signed deal with Texture Capital to run RE.X in the US

– In the process of applying for securies dealer license in the EU

– Applied to the European Regulatory Sandbox with the AMM

– $BRICK is deemed to not be a security by BaFin, the German Financial Supervisory Authority

Token sale | Amount | Unit Price |

|---|---|---|

Seed Token Sale | $200,000 | $0.00417 |

Private Token Sale | $5,000,000 | $0.005 |

Public Token Sale | $1,500,000 | $0.008 |

Polygon ID gives the power to build trusted and secure relationships between users and dApps, following the principles of self sovereign identity and privacy by default.

The interoperable Decentralized Identity System for web3. Experience privacy, interoperability, and increased adoption.

Overview

Our current staff has founded several startups within the tech and real estate industries

We have a special competitive advantage with easy access to assets from DigiShares clients

Advisors

Privileged & Confidential

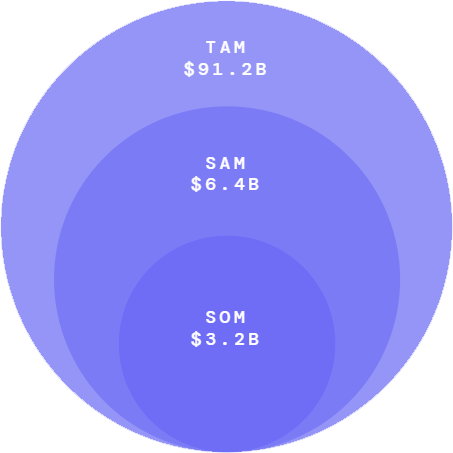

$91.2B

$6.4B

$3.2B

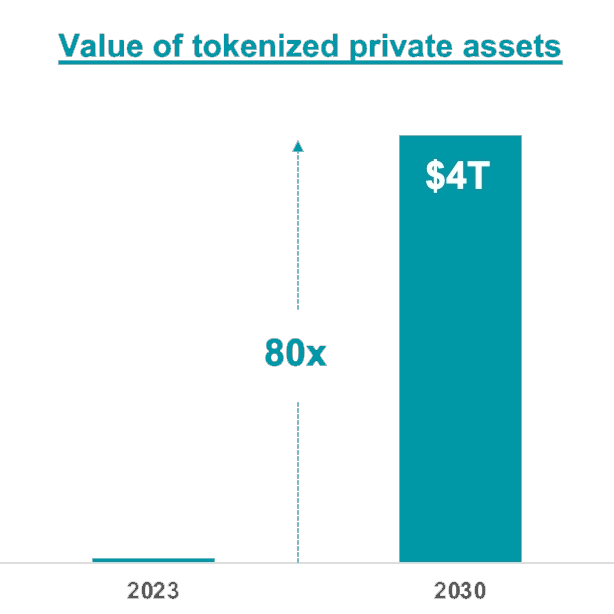

Citi expects mass adoption to be 6 to 8 years away with tokenization expected to grow by a factor of 80x in private markets and reach up to almost $4T in value by 2030

“With the real estate market standing at over $300T, securities at over $250T, regulated open-end funds over $60T, and with private markets growing rapidly, even 1% of the total market share is in the trillions. Early mover advantage could be massive.” – Citi

Boston Consulting Group and ADDX

Fully diluted market cap after private sale:

$50,000,000

Tokens offered for sale:

1,000,000,000 (10%)

Price per token:

$0.005

Minimum tokens per purchase:

1,000,000

Minimum ticket size:

$5,000

Lockup period:

6 months following public sale

$8,000

$350

2%

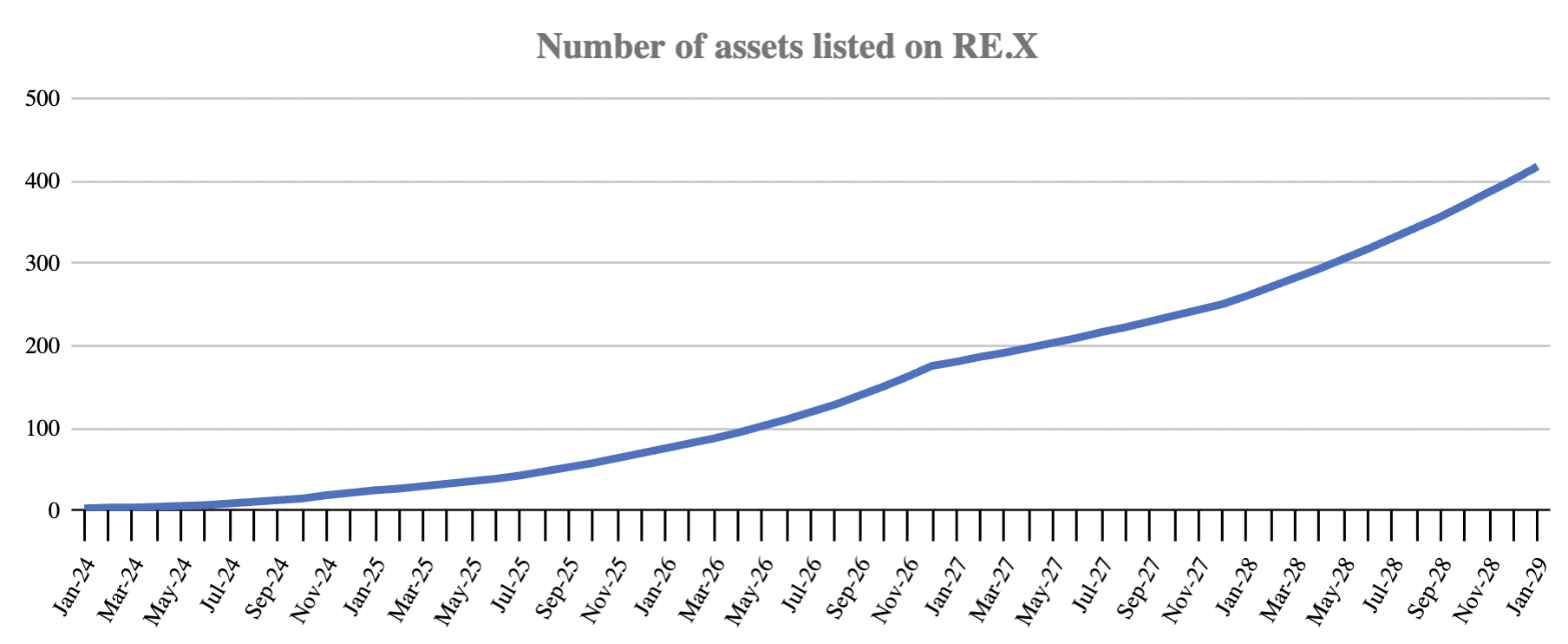

launch of orderbook in the US

BRICK is not used

LAUNCH OF ORDERBOOK IN THE EU

BRICK is introduced

LAUNCH OF AMM IN THE EU

BRICK is used

LAUNCH OF AMM IN THE US

BRICK is introduced if approved by the SEC

LAUNCH OF APP-CHAIN VERSION OF EXCHANGE

BRICK is used

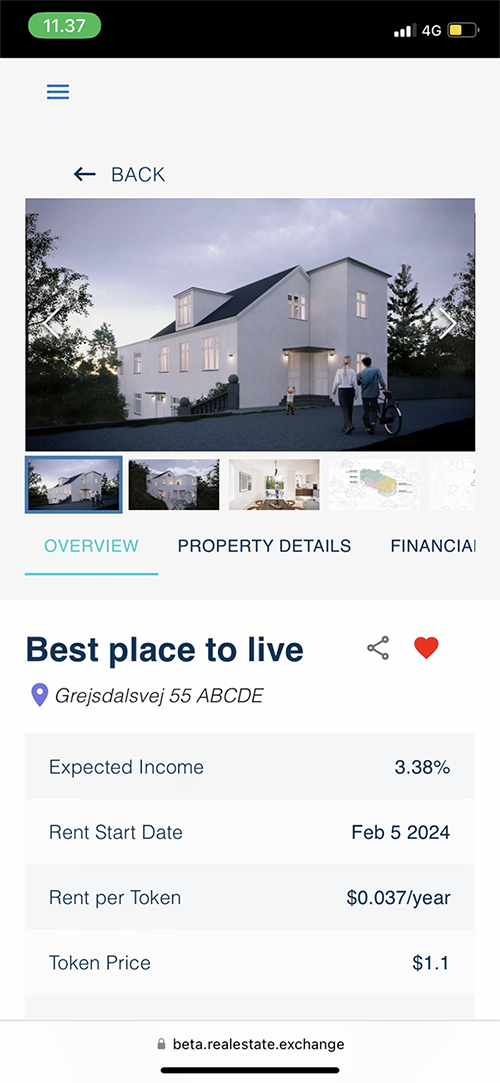

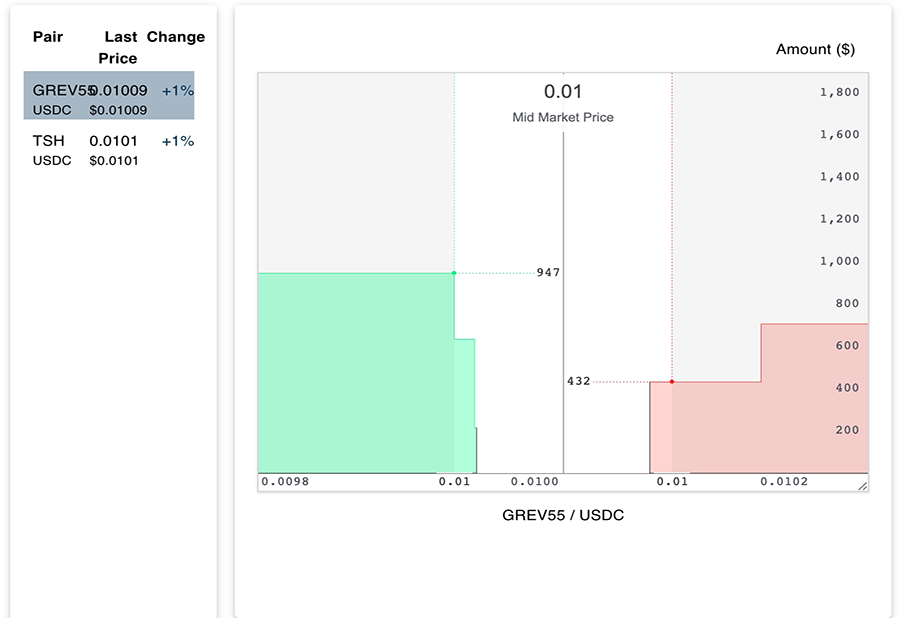

We are currently in beta testing of the exchange RealEstate.Exchange: https://beta.realestate.exchange/

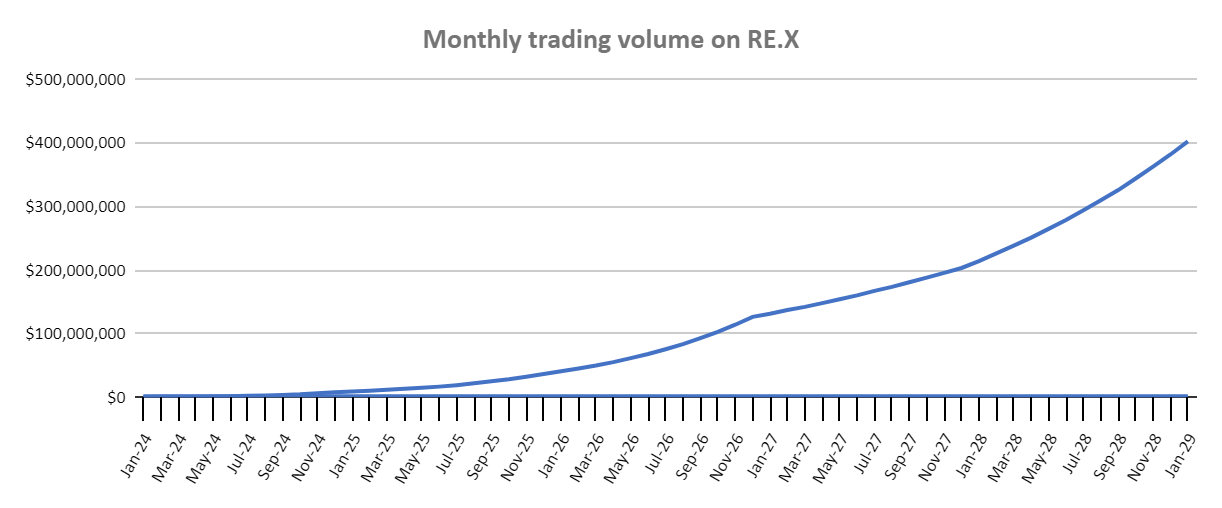

The goal is to use $BRICK as the platform native token and the DeFi-enabler for real estate investments. We work closely with our community, users, and clients to fine-tune the design and function. We aim to complete this phase in the fourth quarter.

Legally speaking the status of RealEstate.Exchange is:

• Launched under the license of Texture Capital, a broker-dealer and ATS, in the US (Q4 2023)

• Securities Dealer License in the EU (Q2 2024) (in application process)

While the technological stage is:

• Bulletin board with order-book and swap (almost completed)

• AMM with Balancer Managed Pools (2024)

We will heavily market the brand of REX through content production and event participation. We will lean heavily on our mother brand, DigiShares, and the existing community of 15,000. We have a unique competitive advantage since we can very easily get access to assets from among DigiShares’ existing clients.

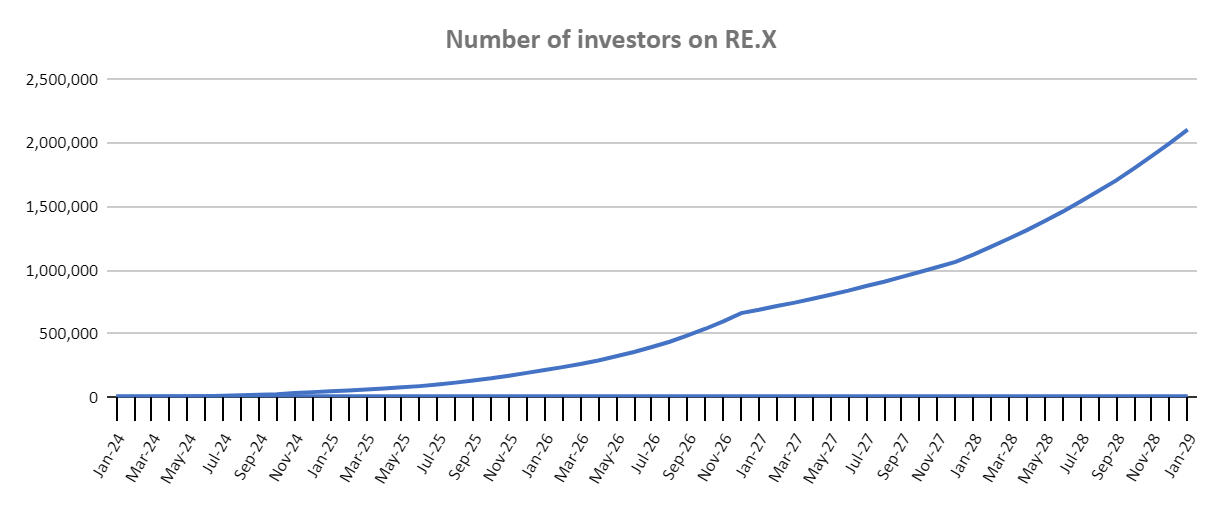

Development of a community: Our goal is to foster an active online real estate investment community and merge it with the blockchain and crypto. This user-centric strategy helps retain users, enhances network effects, and drives product adoption and usage, contributing to a sustainable growth cycle for RealEstate.Exchange.

Integration strategy: We are building on top of existing technology in order to connect and enable other protocol. For instance: Instead of forking an AMM we are building on top of Balancer.fi in collaboration with their team. This approach promotes the revolution of blockchain technology to handle real-world asset tokenization and enables a broad range of users to enter our platform with little to no boundaries.

Our goal is to foster an active online real estate investment community and merge it with blockchain and crypto. This user-centric strategy helps retain users, enhances network effects, and drives product adoption and usage, contributing to a sustainable growth cycle for RealEstate.Exchange.

Anyone can set up pools or trade tokens directly on the blockchain. After the vesting period, you are free to trade the $BRICK-token on the blockchain. The main source of liquidity will be through a pool on Balancer.fi

© 2023 RealEstate.Exchange, Inc.